What is the Exness Calculator?

The Exness Calculator will help you know about potential profits that they can get it figured. Once you feed in your account details like account currency, trading asset, lot size, and leverage. Therefore, it gives an immediate check-up for traders to convince them whether to choose a trade or not.

How to Access Exness Trading Calculator

- Step 1. Log in to Exness: Go to the Exness website → Enter your login details to access your account.

- Step 2. Go to Tools: Find the Trading Calculator in the Tools or Resources section.

- Step 3. Use the Calculator: Start entering your trade details.

Calculator Walkthrough

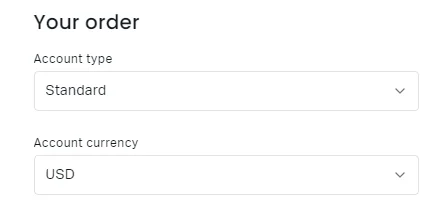

When using the Exness Calculator, the first step is to select your account type and currency. Here’s how:

- Choose Account Type: Select your account type from the dropdown menu. Options include Standard, Pro, Raw Spread, and Zero accounts.

- Select Currency: Choose the base currency of your trading account. This will be the currency in which your calculations are made.

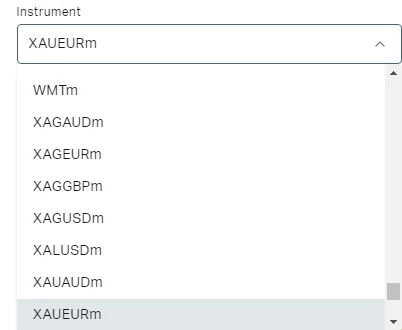

Next, you need to pick the trading instrument you want to analyze. Follow these steps:

- Select Instrument: From the list provided, choose the financial instrument you want to trade. This could be forex pairs like EUR/USD, commodities like gold, indices, or cryptocurrencies.

- Confirm Selection: Make sure the instrument you choose matches your trading strategy and market analysis.

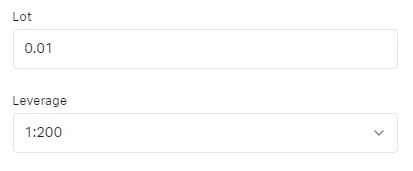

Finally, set the lot size and leverage to get detailed calculations. Here’s what to do:

- Enter Lot Size: Input the number of lots you wish to trade. The lot size determines the volume of your trade and affects your potential profit and loss.

- Choose Leverage: Select the leverage ratio you plan to use. Leverage can increase both your potential gains and risks, so choose it according to your risk management strategy.

Interpreting Exness Calculator Results

Equity Margin and Leverage

The Exness Calculator displays the opening margin and its relationship with leverage. Margin: the money left in your account when you open a new trade (means the amount of money needed to close this position). Leverage is an amount that multiplies your margin. Using more leverage significantly increases both upside versus downside potential.

Exness Spreads and Commissions

Spreads and commissions are both expenses for commodity trading. The buy and sell price of an instrument differ based on the spread. The lower is, so are trading costs. Commissions are applied per trade on certain account types and can eat into returns. With the help of this calculator, you can prominently see all these costs and hence enjoy realistic total expenses.

Swaps and Overnight Positions

Swaps are fees for holding positions overnight. They are based on the interest rate difference between the currencies in a forex pair. The calculator displays any swap charges or credits that apply to your trades, which can affect your overall profit or loss if you hold positions overnight.

Pip Value and its Importance

Pip value is the smallest price move in a currency pair and is essential for calculating profit or loss. Knowing the pip value helps you estimate how much you stand to gain or lose with each price movement, aiding in better risk management and more precise trading decisions.

Example of Using Exness Trading Calculator

Calculating Potential Profits

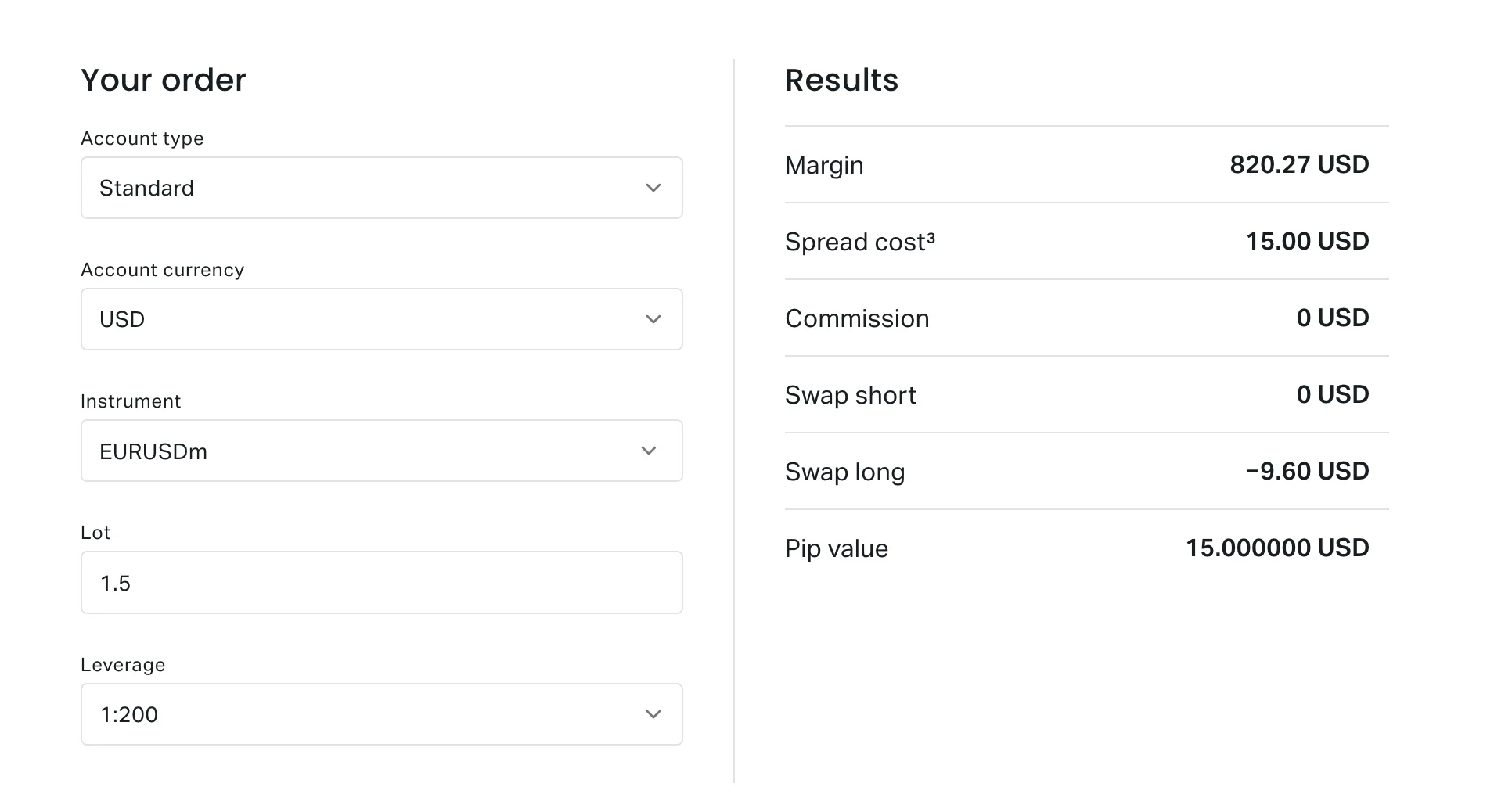

Suppose you want to trade EUR/USD with a Standard account in USD. You plan to trade 1,5 lot with 1:200 leverage. The current price is 1.2000, and you expect it to rise to 1.2100.

- Account Type: Standard

- Currency: USD

- Instrument: EUR/USD

- Lot Size: 1,5

- Leverage: 1:200

- Entry Price: 1.2000

- Target Price: 1.2100

Estimating Trading Costs

For the same trade, the costs might include spreads and commissions.

Assumptions:

- Spread: 1.5 pips (0.00015)

- Commission: $7 per lot

Total Cost:

- Spread Cost: 0.00015 * 100,000 = $15

- Total Cost: $15 + $7 = $22

Risk Assessment Calculations

Calculate the margin required and potential loss if the price drops to 1.1900.

Required Margin:

- Calculation: (100,000 / 100) = $1,000

Potential Loss:

- Calculation: (1.2000 – 1.1900) * 100,000 = $1,000

| Result | Value | Explanation |

| Margin | 820.27 USD | The amount of money you need in your account to open this trade, acting as a security deposit. |

| Spread Cost | 15.00 USD | The cost of the spread (difference between buy and sell price), deducted when you open a trade. |

| Commission | 0 USD | The fee for executing the trade. Here, there is no commission, so no extra fee is charged. |

| Swap Short | 0 USD | The amount charged or added for holding a short (sell) position overnight. No charge here. |

| Swap Long | -9.60 USD | The amount charged for holding a long (buy) position overnight. You are charged 9.60 USD per night. |

| Pip Value | 15.000000 USD | The amount you gain or lose when the price changes by one pip, helping to calculate potential profits or losses. |

How to Use Exness Calculator Effectively

Exness Calculator is another great tool to assist you in planning your trades. It allows you to enter account type, currency, instrument and leverage data so you can have a view of potential profits (or losses) costs and risks. It will allow you to make rational trading decisions based on your work and take full advantage of your strategy.

Common Mistakes to Avoid

However, there are some mistakes that need to be avoided when using the Exness Calculator in order for your results to truly reflect reality. Always choose the right type of account (Standard or Pro) because using the wrong type, you receive incorrect figures.Make sure the base currency matches your account to prevent errors. Setting the correct leverage is crucial, as incorrect leverage affects both risk and margin requirements.

Another common mistake is entering the wrong lot size, which can significantly impact profit and loss estimates. It’s also essential to consider swap rates if you plan to hold positions overnight to avoid unexpected fees. Always take into account spreads and commissions in your count to understand the true costs of trading. In order to calculate the profit and loss on your trades, there are a few things you also need to know such as what is the value of each pip chosen instrument. One last note of caution: the market is always changing, so treat this as a useful calculator and the key to success.

Taking into account the above-mentioned mistakes, you will be able to use the most useful for yourself Exness Calculator. And also improve trade indicators.

Frequently Asked Questions

Where can I find and access the Exness Trading Calculator?

You can find and access the Exness Trading Calculator by logging into your Exness account on the Exness website. Navigate to the Tools or Resources section, where you’ll find the Trading Calculator. It’s a user-friendly tool designed to help you plan your trades efficiently.