What is the Minimum Deposit on Exness?

The minimum deposit in Exness depends on the selected account type:

- Standard Account: Typically requires a very low minimum deposit, sometimes starting from $1.

- Professional accounts (such as Raw Spread, Zero, and Pro) may require a larger initial deposit, for example, starting from $200.

Minimum Deposit for Different Account Types

On the Exness platform, several types of trading accounts are available, each with its own features, including various minimum deposit requirements. Here’s a brief overview of the minimum deposits for different types of accounts at Exness.

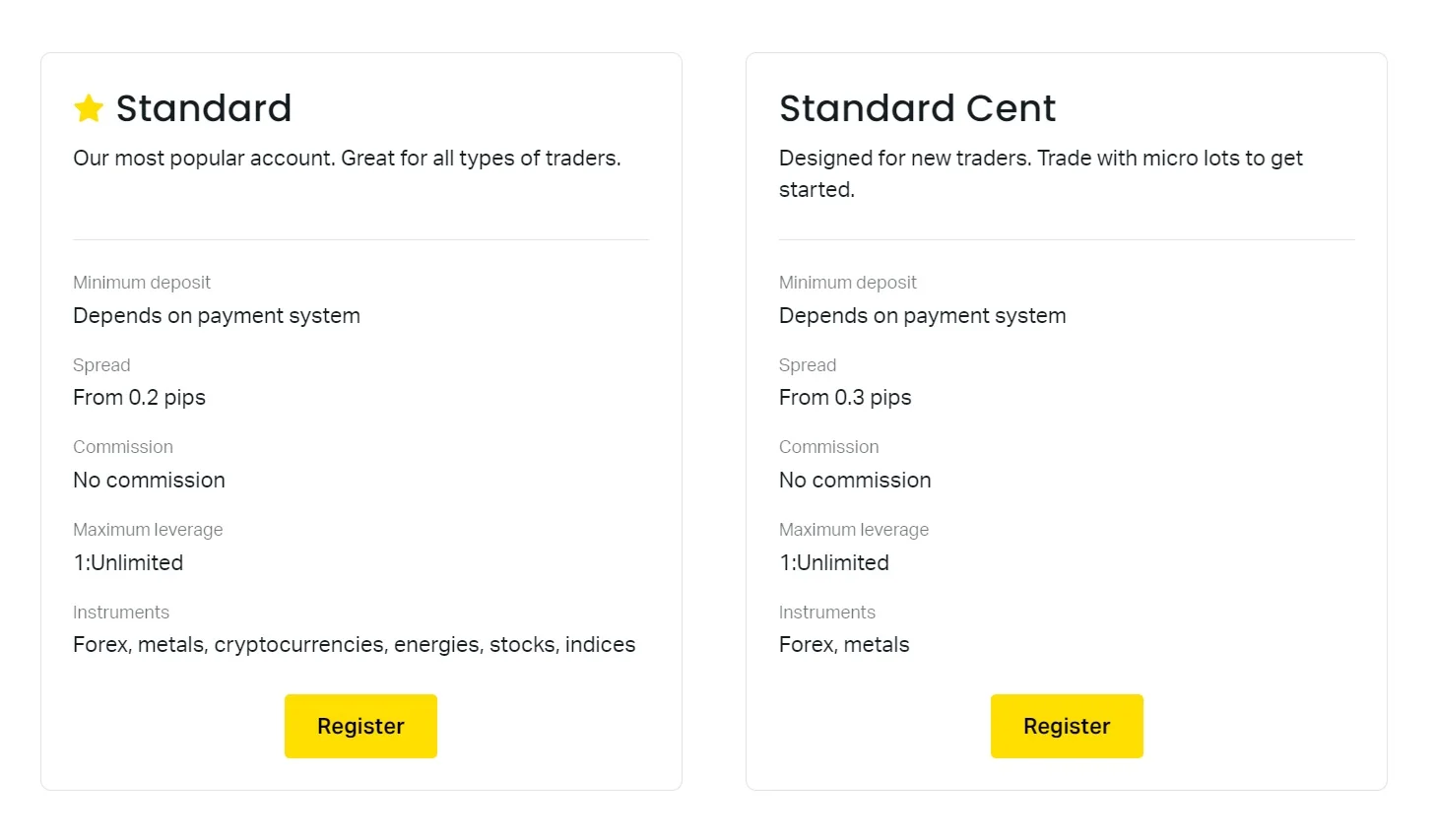

Standard Accounts

- Standard Account: One of the most accessible options, with a minimum deposit starting from $1. This account is suitable for beginner traders as it allows them to start trading with very small amounts.

- Standard Cent Account: Also designed for beginners and requires a minimum deposit of just $1. This account tracks your funds in cents, which is perfect for micro-trading.

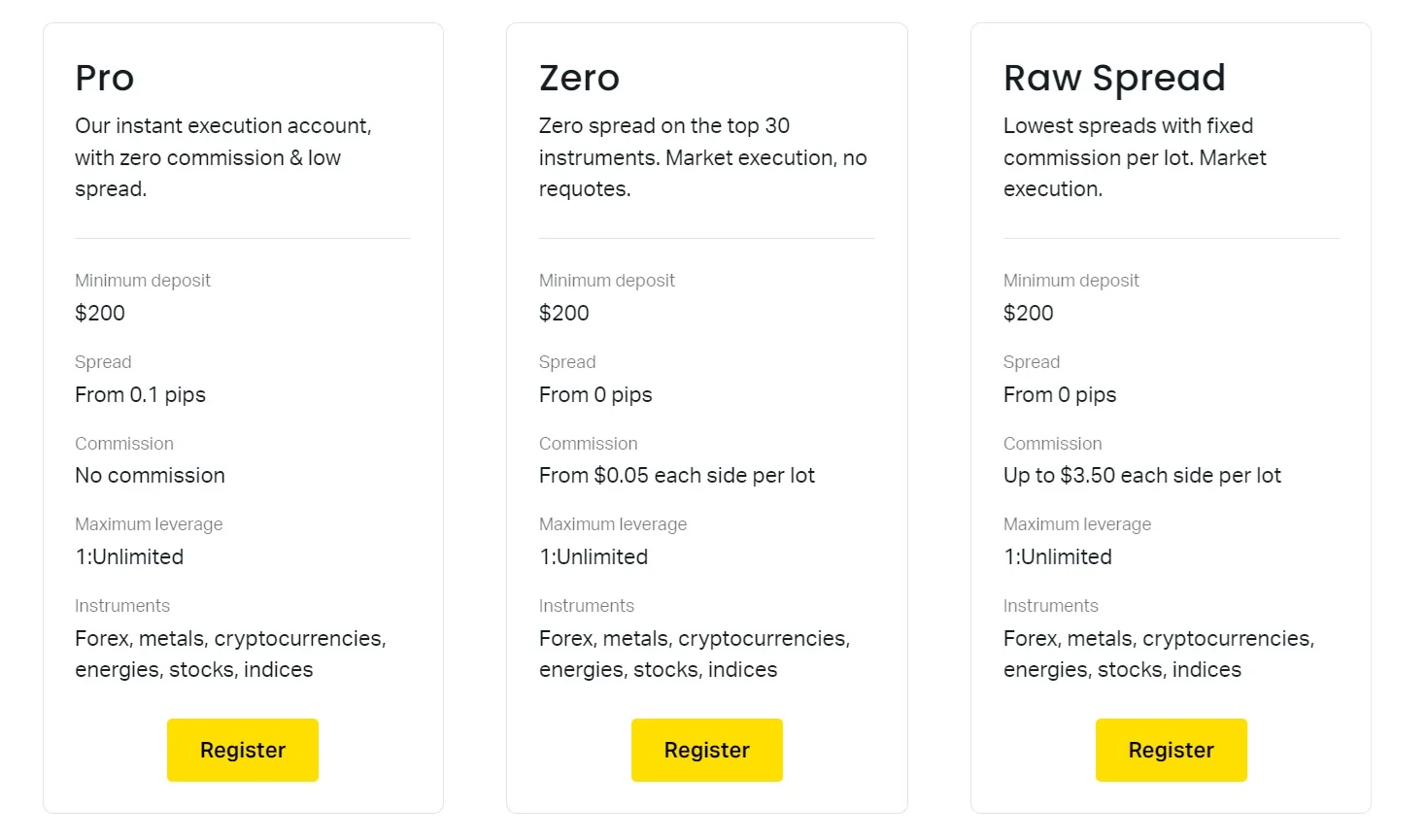

Professional Accounts

- Raw Spread Account: Designed for experienced traders who prefer to trade with the lowest spreads. The minimum deposit for this account is $200.

- Zero Account: Also requires a minimum deposit of $200. This account offers a zero spread on most currency pairs.

- Pro Account: This account is designed for professional traders and also requires a minimum deposit of $200. The Pro account is characterized by lower fees and offers a wider selection of financial instruments.

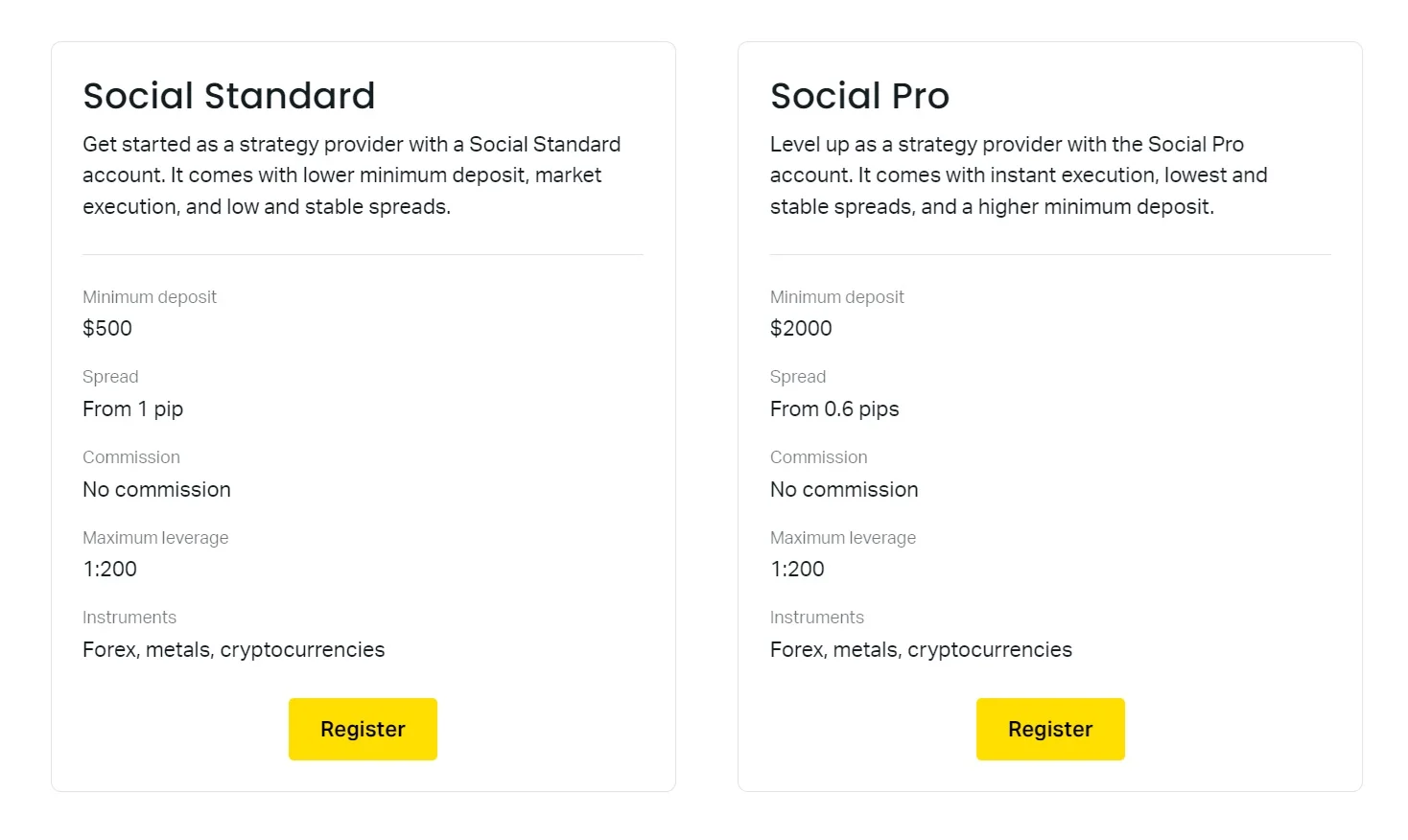

Special Accounts

- Social Trading Account: Exness offers platforms for copy trading, such as Exness Social Trading. The minimum deposit required to participate in social trading usually starts at $10, depending on the strategy you choose to copy.

Advantages of a Low Minimum Deposit

A low minimum deposit opens the door for many traders, providing unique opportunities for those who are just taking their first steps in the world of Forex and other financial instruments.

- Accessibility: The low minimum deposit required for Forex trading makes it accessible to a wide range of traders, including beginners who can start trading with limited risks.

- Strategy Testing: Traders can experiment with various trading strategies without risking large amounts of money.

- Training and Experience: Beginners can practically learn trading platforms such as MetaTrader 4 and MetaTrader 5, developing their skills and confidence without the need for significant financial investments.

- Flexibility: The ability to start with small amounts allows traders to adapt their investments and trading strategies based on their financial capabilities and goals.

- Market Access: Even with small amounts deposited, traders can gain access to various financial markets, such as currency pairs, metals, cryptocurrencies, and indices. This opens up more opportunities for diversification and risk management.

How to Deposit Funds into an Exness Trading Account?

Funding your trading account on Exness is a simple and fast process, accessible through several convenient methods:

- Bank transfer: You can add funds to your account using a direct bank transfer. This method may take several business days.

- Credit/debit card: Adding funds to your account with credit or debit cards usually happens instantly.

- Electronic payment systems: Electronic wallets like Skrill, Neteller, and others provide a fast and convenient way to top up your account.

Exness Deposit through Bank Transfer

- Selecting a bank transfer: In your personal account on the Exness website, select the option to fund your account via bank transfer.

- Receiving bank details: Exness will provide you with the bank details needed to make the transfer.

- Making a transfer: Send money from your bank account to the specified Exness account using the details provided.

- Payment Confirmation: The transfer may take a few business days. You need to keep the payment confirmation in case verification is required.

Exness Deposit with a Credit/Debit Card

- Payment Method Selection: In your personal account, select the option to top up your account using a credit or debit card.

- Card information entry: Enter your card details, including the card number, cardholder’s name, expiration date, and CVV code.

- Transaction Confirmation: Confirm the payment, possibly using two-factor authentication through your bank.

- Instant fund deposit: Funds typically arrive in your trading account instantly.

Exness Deposit Using Electronic Payment Systems

- Choosing an Electronic Payment System: On the Exness website, select one of the supported systems, such as PayPal, Skrill, Neteller, WebMoney, and others.

- Authorization in the system: Log into your account in the selected payment system to confirm the transaction.

- Fund Transfer: Follow the instructions to complete the transaction.

- Instant deposit: Similar to credit cards, electronic transfers usually occur instantly.

Other Important Conditions for Traders on Exness

Beyond the minimum deposit and various account funding methods, the Exness platform offers numerous other important terms and aspects that traders must consider when choosing a broker and planning their trading activities.

Exness Deposit Processing Time

In most cases, deposits are processed instantly, especially when using e-wallets or credit cards. The processing time for withdrawals depends on the chosen method, but Exness aims to process withdrawal requests as quickly as possible.

Spreads and Commissions

- Spreads: Exness offers both floating and fixed spreads depending on the account type. For instance, on Zero accounts, spreads can be very low, which is attractive for scalpers and day traders.

- Commissions: On some accounts, such as Zero and Raw Spread, trading commissions may be charged based on the volume of transactions.

Leverage

Exness offers flexible leverage conditions that can vary depending on the account type, regulation, and market conditions. Leverage can reach up to 1:2000 for some instruments, allowing traders to increase potential profits, but it also increases risks.

Available Trading Instruments

Exness offers a wide range of trading instruments, including currency pairs (Forex), cryptocurrencies, metals, energy carriers, indices, and stocks. This provides traders with flexibility in choosing markets for trading.

Trading Platforms

In addition to a web terminal, Exness provides access to the popular trading platforms MetaTrader 4 and MetaTrader 5, which support automated trading and offer advanced analytical tools.

Educational Resources and Customer Support

Exness provides traders with educational materials, including webinars, video tutorials, analytical articles, and much more. Round-the-clock customer support is also available via chat, email, and phone to address any questions or issues.

Regulation and Licensing

Exness is regulated by several major international organizations, including the FCA (UK) and CySEC (Cyprus), ensuring a high level of transparency and security for traders.

FAQs Exness Minimum Deposit

What is the minimum deposit required to open an account on Exness?

The minimum deposit on Exness depends on the type of account chosen. For standard accounts, the minimum deposit starts at $1, making it accessible to a wide range of traders, including beginners. For professional accounts, such as Raw Spread and Zero, the minimum deposit is typically around $200.